Why Rail Terminals Should Adopt the Hub-and-Spoke Distribution Model

Bill Johnson, Ph.D.

Senior Business Analyst, Professional Services Group Tideworks Technology, Inc.

Hub-and-spoke models for the distribution of goods and services have been successful for large-scale enterprises and are becoming adopted for smaller scales as well. Federal Express implemented a hub-and-spoke model and has famously demonstrated its efficacy, as Roger Frock documented in Changing How the World Does Business. Commercial aviation has followed FedEx’s lead, and now even the healthcare industry is adopting a hub-and-spoke model for the distribution of services to rural locations. Transshipment maritime container terminals, the hubs for vessel services, are the largest and busiest container terminals in the world.

What is the Hub-and-Spoke Distribution Model?

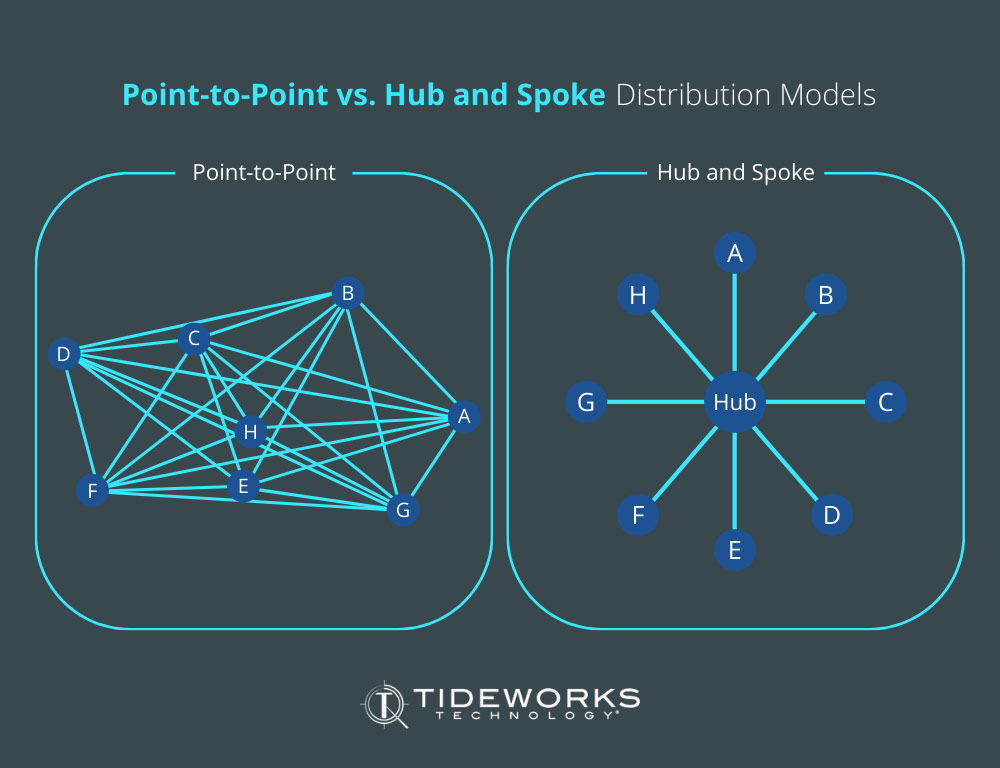

A hub-and-spoke model is a centralized warehousing and shipment system that resembles the structure of a bicycle wheel. The center of the wheel is the hub or a distribution center and each spoke represents a direction of delivery to and from end shipping points or fulfillment centers.

The alternative to hub-and-spoke is the point-to-point distribution model. Point-to-point is a decentralized system where all locations send shipments directly to one another depending on inventory availability and delivery requirements. Employing a hub-and-spoke model provides much great efficiency and lower freight costs.

Adoption of Hub and Spoke in the Rail Industry

With the success of the hub-and-spoke model in the transportation and healthcare industries, the adoption by the rail industry should not be surprising. The concept of the “hub” in the hub-and-spoke rail network is a sorting engine. For a rail hub, cargo of mixed destination arrives, is sorted, and departs as “pure” railcars that are loaded with a single destination. Typically, cantilevered Rail Mounted Gantry Cranes (RMGCs) with long booms, often called Wide-Span Cranes (WSCs), sort the containers. They lift the containers from the inbound trains and ideally place the container directly onto the railcars of the outbound train, a process known as a direct transrail move. The end point terminals that receive and release cargo for customers are the spokes. These end points typically receive low volumes of containers for less populous destinations.

“Switching a rail network’s operation to a hub-and-spoke model affords the opportunity to increase the network’s market share…”

Point-to-Point Shipping: Low Volumes, Full and Pure Railcars

Under traditional point-to-point shipping, the requirement that end points release pure, full railcars results in delays because sufficient cargo volumes must first be gathered to fill the car. To avoid delays or sparsely loaded trains, more of the smallest railcars are needed at all the end points. An equivalent number of single-well cars are more expensive to maintain than a multi-well car. Furthermore, managing the flow of the single-well cars across the network is critical to on-time, low cost delivery. The end point terminals may choose to reserve an inventory of single-well cars, above what is needed for day to day operations. Due to these inefficiencies, low volume destinations are not the best opportunity for rail using point-to-point shipping. Exacerbating the matter, rail networks in the US and Europe today still include many of these low-volume terminals.

Instead, the hub-and-spoke model allows the end points to release trains to the hub terminal with full railcars of mixed destination using any size railcar available. The hub combines small volumes for less populous destinations from the entire network, and builds large, full, pure railcars for delivery. However, the model works only if the hub can efficiently sort the inbound mixed cargo from many terminals into pure outbound railcars for delivery.

Hub-and-Spoke Model: Capture More Market Share Through Low-Volume Cargo Customers

Chris Anderson argues in The Long Tail that working efficiently with smaller volume customers is an important next phase for commerce. Rail networks with a hub-and-spoke model can aggressively pursue low-volume cargo because it is no longer necessarily high in cost. With every rise in the price of gasoline, new market share is available to rail from trucking lines. The networks that can better reduce the costs of servicing smaller volume customers stand to reap greater gains in market share. The opportunity exists for the rail network that can seize it.

Two examples of hubs for rail networks are CSX’s Northwest Ohio (NWOH) Terminal in North Baltimore, Ohio, and in Europe, “Megahub” in Hannover-Lehrte, Germany.

Megahub

Megahub in Hannover-Lehrte, Germany, is currently under construction and expected to be completed in 2016. Operations will begin this year on a portion of the terminal. When complete, Megahub will have three WSC’s operating over two sets of three 2300 feet long processing tracks.

CSX Northwest Ohio

Operational since 2011, the NWOH terminal reached its planned capacity of handling 30 trains per day and 2 M TEU per year and is still expanding. The rail yard has eight processing tracks that were initially 3000 feet long and are now 8000 feet. CSX added three WSCs to bring the terminal’s total to eight, and they perform transrail moves almost exclusively. As an emphatic demonstration of what this terminal does and does not do, it has less than 500 parking spots for wheeled cargo. NWOH is a transrail hub, positioned to distribute goods between the East Coast and the Midwest as part of the National Gateway project.

The Risk of Hub and Spoke: Increased Competition for Large Customers

Even with an efficient hub, a hub-and-spoke network is not without risk. Loss of large customers is possible. In The Future of Intermodal Freight Transport: Operations, Design and Policy, J. W. Konings argues that reductions in rail regulations in Europe have allowed for new rail carriers to begin operations more easily. The newcomers compete by tailoring their services to the high-volume links in the network. Two hub-and-spoke carriers that faced this competition restructured their network to use direct routes in 2004. Konings reports that in a region that spans from Hamburg, Germany to Le Havre, France, most rail carriers use a mixture of direct links and hub-and-spoke connections today.

So, it doesn’t have to be a one or the other decision. There will still be cases due to competition and volume where a combined model makes sense for certain rail networks. A combined model is essentially a hub-and-spoke network with a few direct connections for high traffic corridors that don’t use the hub because that would actually be less efficient. The high traffic corridors supply enough volume to create large efficient trains on their own without the need to gather additional volume from the hub.

The Increased Need for Efficiency Through Automation and Optimization

Switching a rail network’s operation to a hub-and-spoke model affords the opportunity to increase the network’s market share by gaining smaller customers. To realize that opportunity, the sorting hub must be efficient. Reducing the cost of the hub’s operations through automation and optimization is critical.

NWOH uses Tideworks’ Intermodal PRO (IPRO) and Traffic Control products for planning and dispatch and Mi-Jack’s Mi-Star Global Positioning System (GPS) product for the semi-automatic control of the WSCs.

Modern Rail Terminal Operating System (TOS)

Intermodal PRO® is a modern terminal operating system that provides the features and functionality any size terminal needs today and into the future. Our TOS empowers terminals beyond basic functionality to access precise data intuitively.

IPRO eliminates the guesswork from planning with easy-to-use graphical planning tools to help intermodal terminal operators maximize throughput, increase terminal utilization and achieve a greater return on their technology investment.

Key features include extensive reporting, advanced integration, automatic rail planning, just-in-time planning to grounded or wheeled locations, and advanced integrations with third-party software solutions.

Planning, Dispatch, and Equipment Control System

Traffic Control is the next generation of Equipment Control Systems providing terminal operators with the latest advances in equipment dispatch and equipment automation. Traffic Control was designed for the long haul and to guide customers through years of operations. Equipment dispatchers and mobile client users will benefit from a modern user interface with clear visibility of moves and commands on client screens optimizing their productivity and performance.

Traffic Control provides automatic work order generation, optimizes the number of direct to rail moves, and load balances across all the WSCs, and optimizes their work order sequence to minimize delays.

3D Data and Terminal Visualization Tools

Visualization of the complex interconnectivity of the terminal is a powerful tool for operations teams. Terminal View® data visualization tool displays a real-time, three-dimensional representation of all operations, providing full operational visibility into your terminal. View handling equipment location and status, current inventory, move status, and more.

3D Data Visualization gives you the ability to make strategic decisions about your terminal operations based on what you see happening in your terminal every day. Quickly find the cause of inefficiencies and solve problems proactively as you see them unfold. There’s even a playback feature to review your operations from an hour or two months ago.

See Terminal View in action in our 3D Data Visualization Demo

See Terminal View in action in our 3D Data Visualization Demo

Hub-and-Spoke Networks are Here to Stay

The adoption of hub-and-spoke networks is arguably as significant an event in shipping efficiency as containerization itself. Catering to the large numbers of smaller customers is also a new standard. Shrink-wrapped solutions work well for the larger players in most markets, but the companies that can service the smaller players efficiently have a substantial advantage when growing their market share.

About Tideworks Technology

Tideworks is a full-service provider of cost-effective, reliable software solutions for growing terminal operations and shipping lines worldwide. The company helps more than 300,000 users at 100 facilities run their operations more efficiently and profitably. From optimized equipment utilization to faster turn times, Tideworks works at every step of terminal operations to maximize productivity and customer service.